Foreign entities who want to open a company in Malaysia can choose from several legal options through which they can establish their business presence in this market. The main ways in which a foreign business can be set up in Malaysia are through a representative office, a branch, or a subsidiary. There are significant differences between the above-mentioned entities and our team of agents specialized in company formation in Malaysia can offer more details on this matter.

| Quick Facts | |

|---|---|

| Applicable legislation (home country/foreign country) |

Malaysian Company Law |

|

Best used for |

– banking, – insurance, – trading, – manufacturing |

|

Minimum share capital |

Yes |

| Time frame for the incorporation (approx.) |

Around 4 months |

| Management (local/foreign) |

Local or foreign with residence in Malaysia |

| Legal representative required |

No |

| Local bank account |

Yes |

| Independence from the parent company | Yes |

| Liability of the parent company | No, the subsidiary is fully liable |

| Corporate tax rate | 24% |

| Possibility of hiring local staff | Yes |

Table of Contents

What is a subsidiary in Malaysia?

One of the ways in which a business can be set up here is through a subsidiary. This entity refers to a type of company that is controlled by another company. It is important to know that a subsidiary in Malaysia is controlled to a certain degree by another legal entity, which can be a holding company or a parent company.

In order to qualify as a Malaysian subsidiary, a company needs to comply with a set of legal requirements, which are stated under the Companies Act. Our team of consultants in company registration in Malaysia can advise businessmen on the characteristics of the local subsidiary, which should include the following:

- the parent company has the right to control the Malaysian subsidiary when appointing the company’s board of directors;

- the subsidiary is owned up to more than 50% in terms of voting rights by the parent company;

- the parent company owns more than 50% of the issued share capital of the subsidiary;

- the parent company can appoint and change the majority of the subsidiary’s directors.

The name reservation is required for subsidiaries in Malaysia, where a flat fee of around RM 50 is solicited. Such a name verification and reservation can be made online with the SSM, the institution that can reserve the name for 30 days.

More information on the subsidiary in Malaysia is available in the video below:

However, a subsidiary is an independent entity and it does not reflect the same legal structure and taxation system the parent company is subject. Foreign investors establishing a subsidiary in Malaysia should know the incorporation process available here; our team of company incorporation representatives can provide more details.

Setting up a business in Malaysia involves some straightforward procedures and formalities. Our local agents can help foreigners interested in this and guide them regarding the necessary documents, opening a bank account, as well as registering for the payment of taxes. We mention that only one shareholder is needed to establish a limited liability company, the simplest business structure available. So contact us for a free case evaluation.

The authorized share capital of up to RM 400,000 is subject to a fee of RM 1,000. For authorized capital ranging between RM 400,001 and RM 500,000, a fee of approximately RM 3,000 is imposed. Around RM 70,000 is the fee for authorized capital surpassing RM 100,000,001.

What are the main characteristics of a Malaysian subsidiary?

We have presented so far some of the aspects that define the Malaysian subsidiary. However, besides the above-mentioned, the subsidiary in Malaysia is characterized by other relevant matters. Below, investors can learn more about the characteristics of a subsidiary, but in-depth advice concerning this legal structure can also be offered by our team of consultants in company registration in Malaysia:

- the subsidiary’s trading name can be a different name than the one of the parent company;

- a subsidiary can operate in most of the Malaysian business sectors, but it can’t be set up in specific strategic sectors;

- it can be registered by both local and foreign companies wanting to expand their activities in Malaysia;

- the subsidiary can be registered with 100% foreign ownership, with the exception of certain business sectors;

- it represents a different legal entity than the one of the parent company;

- it can be incorporated by a maximum number of 50 members;

- it can be set up by a single shareholder and it can appoint a single director;

- the director does not have to be a Malaysian citizen, but he or she must own a work permit issued by local authorities and needs to have an official residential address in Malaysia.

Private limited liability companies in Malaysia are often selected for establishing subsidiaries in this country. This structure is the most popular in Malaysia and needs only a director and one shareholder, being quite beneficial for international entrepreneurs.

The post-registration requirements involve appointing a company secretary and opening a bank account. Such formalities also enter the attention of our local specialists with experience in company incorporation in Malaysia.

How can foreign companies start a subsidiary in Malaysia?

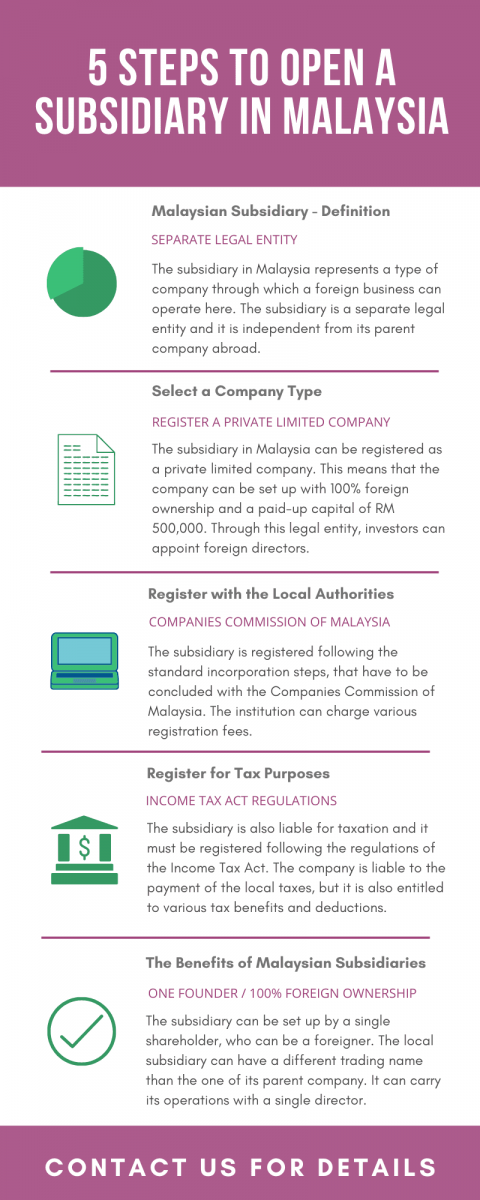

In order to establish a subsidiary here, the entrepreneur must choose a legal entity under which he or she should carry out the business. There are several business forms available for foreigners, who can choose from businesses set up as partnerships or limited companies. Below is an infographic with information about subsidiaries in Malaysia:

What are the advantages of registering a subsidiary as a private limited company in Malaysia?

One of the main advantages of registering a subsidiary as a private limited company refers to the fact that this type of business form allows 100% foreign ownership. In the case of a foreign company, the paid-up capital is established at RM 500,000 and, as a general rule, businessmen can invest on the local market in most of the investment sectors, but certain restrictions do apply (in the sense that the local legislation restricts wholly foreign ownership for businesses related to education, agriculture, and tourism, for example).

In the case of a subsidiary registered as a private limited company, Malaysian legislation stipulates that the business can have foreign directors, as long as the respective persons have a residential address in this country. In this case, it is necessary to appoint at least one director.

Subsidiaries in Malaysia can have both local and foreign staff. However, business owners should pay attention to the immigration matters and especially the work and residence visas for Malaysia. One of our experts in immigration matters can manage the employment formalities.

A partnership in Malaysia can be carried out by at least two partners, who are liable for the business’s debts with unlimited liability. A limited company can be set up as a public limited company or a private company and the main difference is given by the participants in the company’s shares (public/private).

What are the main tax and reporting requirements in Malaysia?

A subsidiary in Malaysia will be treated as a local company from a tax point of view. The same is applicable for its reporting requirements. Thus, those who want to open a company in Malaysia as a subsidiary have to file financial documents with the Companies Commission of Malaysia and need to conduct a yearly audit of the company’s accounts.

Regarding its taxation, the Malaysian subsidiary can benefit from local tax incentives, even though it represents a sub-division of a foreign company. The company will be taxed with a corporate tax rate of 24% on its local income. There are also specific conditions under which companies can benefit from a lower corporate tax.

Besides the lower corporate tax rate, a subsidiary in Malaysia can benefit from various tax incentives, as we mentioned above. The company can qualify, under specific conditions, for the tax benefits that are prescribed under the Promotion of Investment Act and the Income Tax Act; the advantage of registering a local subsidiary is that it can benefit from the tax regulations available for local businesses, while a branch office can’t.

It is also necessary to know that this business structure does not have any restrictions concerning the employment of foreign workforce and our team of specialists in company formation in Malaysia can inform investors of the employment regulations applicable in this case.

Once a subsidiary is registered in Malaysia, a company secretary must be appointed in a maximum of 30 days from the date of incorporation. It is good to note that the company secretary must be recognized by the SSM which normally issues a certificate of practice in this sense.

What are the taxes for 2024 on the registration of a Malaysian subsidiary?

When registering a Malaysian subsidiary, the local legislation does not stipulate any particular taxes or fees; however, those opening a company in Malaysia must be aware that the subsidiary has to be registered following the standard incorporation procedure, during which the investors will have to pay specific fees.

For example, some fees can be imposed when drafting the company’s statutory documents, which are represented in this case by stamp duty. When registering a trading name for the subsidiary, the procedure will be concluded through the Companies Commission of Malaysia, which requests the payment of a fee of RM 60; the registration is available for one year, at the end of which the subsidiary will have to apply for a renewal.

If the subsidiary will be registered as a private company, the Companies Commission of Malaysia will request a registration fee, which is established based on the selected legal entity. For example, the fee for registering a company limited by shares is of RM 1,000.

If the company is registered as a private limited company, the investors can modify the legal entity of the company, by changing it into a public limited company. In this case, the institution imposes a fee with a value of RM 500. Our team of specialists in company formation in Malaysia can advise investors on the procedure available for changing the business form of a local business.

The subsidiary in Malaysia operates as a corporate entity (a business form with a legal personality), and such entities are required to submit annual financial statements and other accounting documents on a yearly basis. In 2024, lodging financial statements for a private company will cost RM50 in the case in which the company must submit the audited financial statements and RM20 for financial statements that do not need an audit. Those who need to extend the deadline for submitting the financial statements will have to pay a fee of RM 100.

Persons who need to receive more details on the registration of a subsidiary in 2024 can address to our team of company incorporation consultants in Malaysia. Our team of specialists can also advise on the taxation scheme applicable to this structure, as well as on other associated aspects concerning the registration of this business form.